Barbados government’s haste to grab tax revenue, a determination of distributors to sell their product regardless of health consequences, and fluctuation in the Trinidad currency have combined to dull the intended effect of a sin tax on sugary drinks.

With one in five persons afflicted by diabetes in its general population, and that ratio increasing to one out of every two adults above the age of 65, health officials convinced the Barbados government that radical action is needed against non-communicable diseases (NCD), and sugar should be targeted.

This resulted in a 10 percent surtax being slapped on all local and imported sugar-sweetened beverages in 2015.

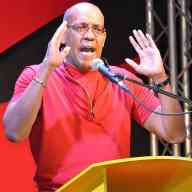

Lecturer at the University of the West Indies, Professor Alafia Samuels, said that the sugary drinks were singled out because, “the Caribbean has the highest consumption of sugar-sweetened beverages in the world. On average, people in the Caribbean drink two sugar-sweetened beverages per person per day,” and this is the main reason that, “four out of 10 women are obese, and two out of 10 men are obese”.

But she said last weekend that the Barbados government’s overriding focus on earning the extra revenue was the first factor to soften the desired effect of the sin tax measure.

“Usually when we are going to do something like this, it is a health intervention, and so it would be important to have public education to prepare the public.

“But in reality, in Barbados this intervention was driven more by tax revenue. And so it was announced and implemented quickly without a chance for real public education to take place,” said Dr. Samuels, the director of the George Alleyne Chronic Disease Research Centre.

She said that while government has been successfully reaping its revenue over the almost three years, “the industry has absorbed some of that tax, and on the shelf you [consumer] are only actually seeing a six percent tax difference in prices.”

Samuels pointed out that this reduces the impact of the price increase, which was intended to discourage consumers from purchasing many sugar-sweetened drinks.

“Obviously it’s what the consumer faces when they are going to the checkout register that matters, and the consumer is facing only a six percent difference, and this is going to influence their behaviour.”

The impact of that 10 percent, effectively cut to six percent, sin tax has been further reduced by a drop in value of the currency of Trinidad, from where Barbados imports many of its drinks.

“The Trinidad and Tobago dollar has been weakening over time, which means that their products, including their sugar-sweetened, beverages coming into the island are actually more competitively priced.

“It meant that some of those drinks are at a lesser price than they would have been had the Trinidad dollar remained stable,” she said of this uncontrollable factor.

Samuels is now calling for that sin tax on sugar-sweetened drinks to be hiked from 10 percent to 20 percent, but unless it is accompanied by public education on the dangers of over-consumption of sugar, government is convinced not to focus only on the extra revenue, and beverage distributors are persuaded not to lower the price to ensure sales, the impact of that recommended 50 percent tax increase will be equally blunted.