Air BNB boasts a US$2.6 billion haul from business worldwide in 2017, but despite Barbados being a principal player in that money build-up, the island received nothing in revenue and the new government has said this has to stop.

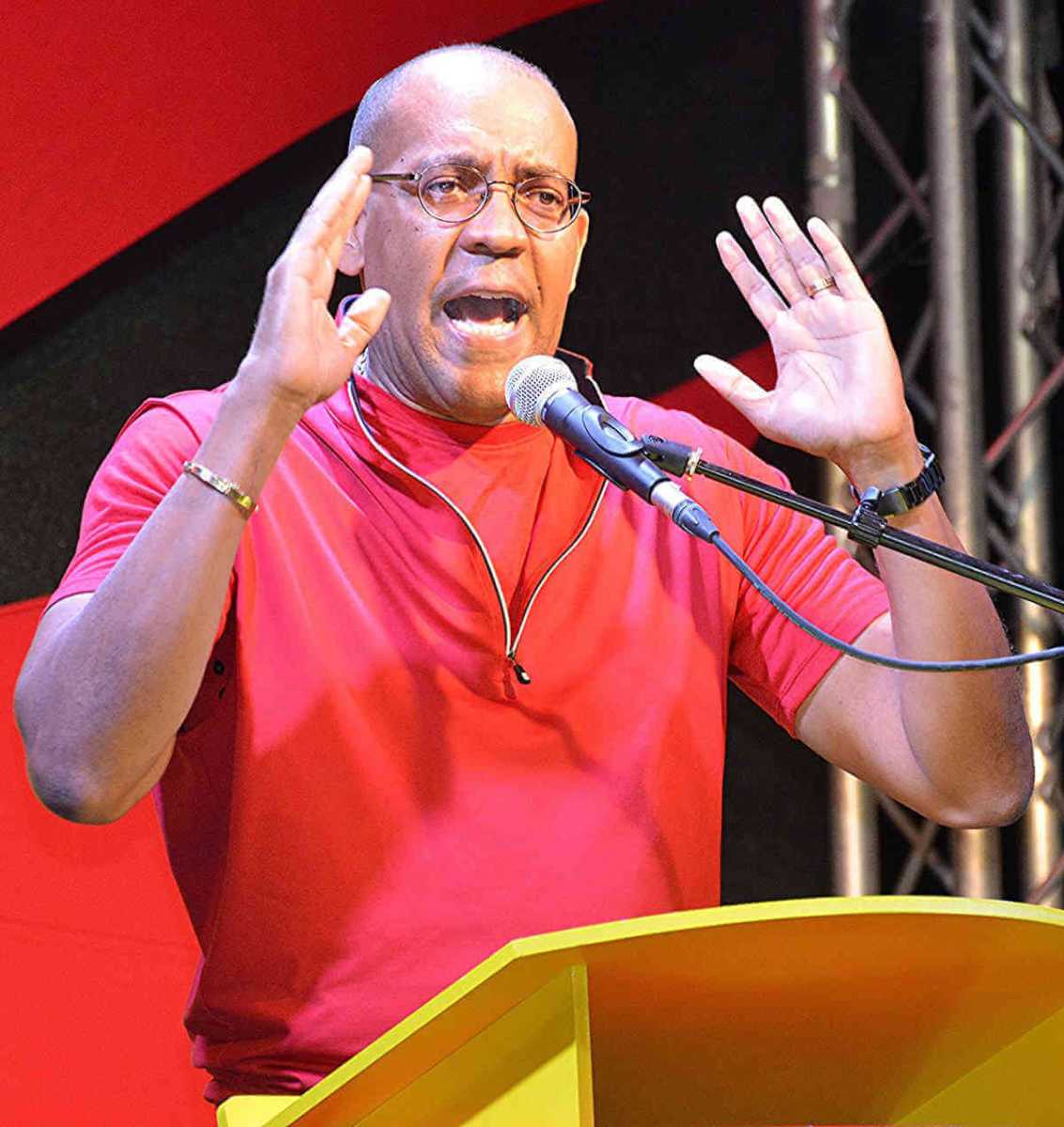

In fact, the recently appointed Minister of Tourism, Kerrie Symmonds, said this week that Air BNB is only one of a number of personal accommodation international businesses that have mushroomed over the last 13 years and are making a tidy living in Barbados among other places, but paying no taxes.

Symmonds said that as far back as 2005 Barbados visitor-room accommodation began increasing in non-traditional ways.

“We’re not seeing it in the hotel sector, but in the privately-owned entities which may be houses that put up a room, the villa market, multi-tier accommodation, condominiums,” he said, adding that occupancy is fuelled by a peer-to-peer network in which owners attract guests, through property managers, and as a result, “there is a significant (increase) in room inventory… are available for rent in Barbados for tourism purposes.”

He said government has identified 3,000 unregistered tourist accommodation units, which it will have licensed, and conservatively estimated that once those entities are brought into the tax stream by October “we should be in a position in the first fiscal year to get Bds$8 to $10 million (Bds$1 = 50 cents US) into the coffers of Barbados.”

“These entities that constitute the so-called sharing economy… they do not own any lodging. They come here and do business here and they act essentially as brokers, receiving a percentage of the service fee. They are the intermediary that allows the guests in Europe or in the United States to come here to a host accommodation.

The minister said, “Many of those entities are not registered,” adding that they have been assessed to average US$336 per night room rate.

“That is comparable to some of the five-star [hotels] on the West Coast of Barbados.

“Effectively, therefore, we have a substantive amount of business taking place, which is not registered,” Symmonds said.

Striking the attitude of an administration faced with the challenge of fixing an economy long in recession, Symmonds said that government intends to have such tourism accommodation homes registered and made to pay their fair share of levies, “and where there is non-compliance shut down the operator.”

“We cannot allow entities of that nature to effectively dig a subterranean tunnel under the revenue of Barbados enroute to finding the bank that they do business with.”

While making it clear that government does not “want to stifle entrepreneurial spirit” he argued, “but you can’t talk about stifling something that has been existence since 2005.”

He said the solution is to have a zero-tolerance approach to this type of business “if it is not registered and paying its fair share.”

Facing a debt level of more than Bds$15 billion, with public liability as a proportion of national income at 171 percent, this government that came to office on May 25 has begun showing a determination to get every dollar due to Barbados.