Caribbean trade bloc governments are to hire an American lobbyist to help them stop United States commercial banks from cutting ties with those in the Caribbean and to help erase a perception that the region is a high risk area for illegal transactions.

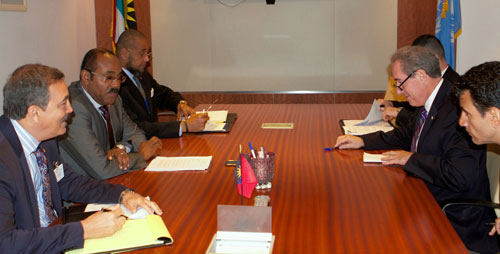

Antiguan Prime Minister Gaston Browne who heads the sub committee looking at the issue said leaders took a decision late Thursday to hire a so far unidentified lobbying firm to run with the issue.

Several mega American institutions such as Bank of America and JP Morgan Chase have severed ties primarily with locally owned banks saying federal agencies have increased the pressure on them to scrutinize transactions from the region and this has driven up costs they are unwilling to carry.

The issue was one of the main agenda items on Thursday, the opening day of the two-day mid year leaders summit.

“We agreed that we will employ the services of a lobbyist to help us lobby this issue and to make sure that we continue to manage this existential threat that is facing the region,” Browne said. “If this process continues, then we may end up with a cartel of foreign banks literally operating within the region and you know the consequences of that- they will continue to gouge us,” he warned.

But he did concede that no additional banks have fallen victim to the process commonly referred to as de-risking in recent weeks, noting that it appears that “there has been a stay in banks de-risking. There is no formal agreement to that effect, but in terms of the action we have not seen or heard any such notice for further de-risking,” he said.

Indigenous banks from Belize in Central America to Guyana and Suriname on South America’s Caribbean coast have fallen victim to the severing of ties. Some have switched to Crown Agents Bank of the United Kingdom to process checks, wire transfers and other transactions at costs that are higher than BOA and Chase for example.

He said the issue has affected governments as well as some have had problems getting transactions processed to pay for imports. He said most countries in the bloc buy up to 80 percent of their imports from the United States and need the services of banks to process transactions.