Unless and until international prices for their key exports increase in the coming months, governments of two of the Caribbean trade group’s larger economies will be forced to continue dipping into special rainy day accounts to keep economies afloat officials said this week.

When decision makers both in Trinidad and Suriname had set up special heritage and stabilization funds a few years ago, they did so with the far future in mind as oil prices were booming, rates for gold at runaway levels and commodity exports for products like bauxite decent.

But as oil and gold prices climb back all too slowly, officials in the two countries have watched helplessly as central bank reserves have dwindled and as receipts from exports tanked.

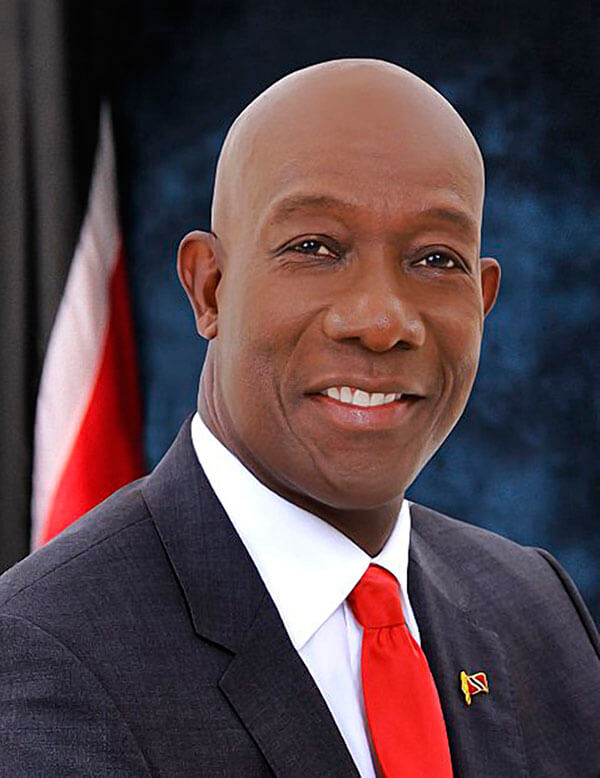

In the case of Trinidad, the administration of Prime Minister Keith Rowley has said it has no other choice but to borrow from the stabilization fund as it is the only source of income to top up the little it is getting from oil, gas and petroleum exports.

Officials in Suriname on the other hand have asked the IMF to intervene in the economy and lend the central bank about $480M in budget support because its special reserve fund has declined in the past year from $1B to less than $400M, a development that triggered panic in many circles in the country.

In Trinidad, opposition lawmakers and media analysts pressured Finance Minister Colm Imbert into explaining on the floor of parliament reasons for withdrawing a whooping $4B from the special fund to pay basic bills including wages.

Despite the withdrawal, the special fund still has about $8B as he assured the nation there is little need to worry about the fund being empty.

“The Heritage Stabilization Fund draw down therefore was simply to finance the well-known budget deficit, not for any item in the budget in particular.” He said it was the only source of funding available to the state.

He also said petroleum revenues in 2015 fell short of projections by 40 percent leaving authorities with little choice.

The minister even suggested that the previous administration which lost general elections last September had used up all of the surpluses left by the administration it had succeeded back in 2010 and had run government accounts into full overdraft.

“In other words the draw down was simply added to the revenues we collect from other sources to collect to help meet our expenditure commitments both current and capital expenditures to pay bills.”

And while officials in Trinidad are battling to stabilize the economy, fellow producer and neighbor Suriname is also in deep economic crisis.

It too had stashed away more than $1B in the Central Bank only to see oil prices dip and remain low. The gold market also dipped significantly as well as rates for bauxite. These three are its main exports.

Today that account has been decimated by 40 percent, forcing Suriname to ask the International Monetary Fund to lend it about $480M in budget financing to stabilize the situation.

This week the IMF announced plans for a mid-July opening of a special office to monitor the situation in Suriname as there are real fears that its fortunes could worsen in the coming months.

Still there is hope for a turnaround, albeit small as oil prices have just edged past the $50 mark with tiny indications that rates will improve slowly in the coming weeks.